Free Printable Tax Transcript

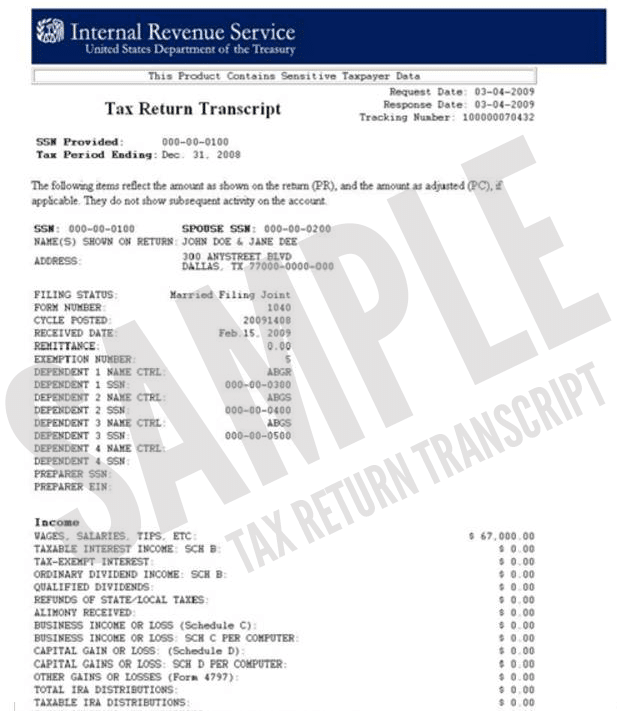

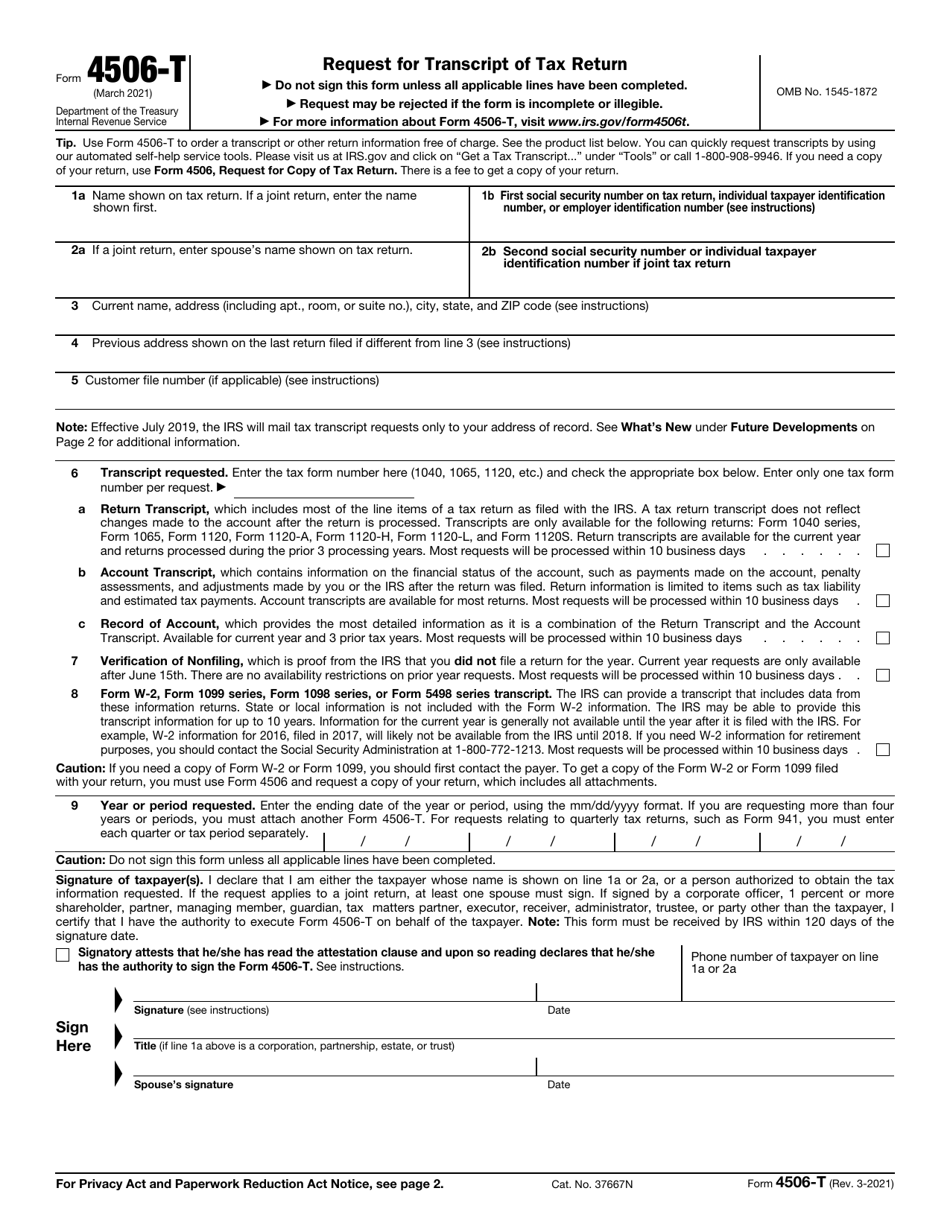

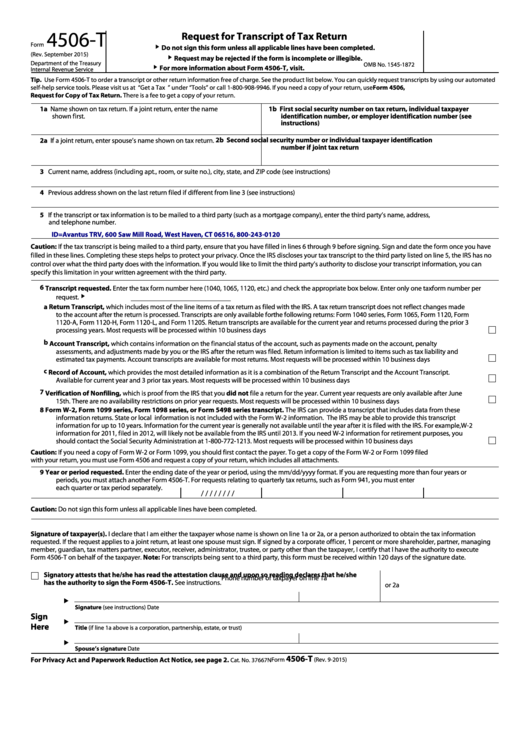

Free Printable Tax Transcript - Irs instructions help you get past year returns easily. Transcripts are free and faster to obtain, while copies incur a fee and take longer to process. Requesting a transcript by mail is possible as well, but it can. Requesting a tax transcript is a simple and free process. Learn how to get a free transcript or a copy of your federal tax return online, by phone, or by mail. The irs even has an online portal, which you can use to request either a pdf on your computer or a paper copy in. This form allows you to request a transcript of your tax return or other tax information from the irs. You can request a free tax transcript from the irs online through the get transcript tool on its website. An official website of the united states government. You can choose from different types of transcripts, such as return, account, record,. You can request a transcript electronically through the irs. For fast help, go online to www.irs.gov and click on get your. Irs instructions help you get past year returns easily. Check if you're eligible to use direct file, the new free tax tool to file your federal taxes directly with the irs. You can request a free tax transcript from the irs online through the get transcript tool on its website. Irs transcripts are best and most often used to validate past income and tax filing status for mortgage and other loan applications, and to help with tax preparation. There are 2 ways to get a business tax transcript: Transcripts are free and faster to obtain, while copies incur a fee and take longer to process. Printing a copy of your old tax return on freetaxusa is free. Requesting a tax transcript is a simple and free process. An official website of the united states government. You can easily get a free copy of your tax transcript by creating or logging into your online irs account. Transcripts are free and faster to obtain, while copies incur a fee and take longer to process. Irs free file lets qualified taxpayers get free tax preparation, free electronic filing and free. Printing a copy of your old tax return on freetaxusa is free. The irs even has an online portal, which you can use to request either a pdf on your computer or a paper copy in. For fast help, go online to www.irs.gov and click on get your. How can i request a tax transcript? You can request a transcript. Irs free file lets qualified taxpayers get free tax preparation, free electronic filing and free direct deposit of their federal tax refund, if they’re owed one,. Requesting a tax transcript is a simple and free process. Get the tax account transcript for the agi shows basic tax return data such as filing status, taxable income, and payment types. View, print. Requesting a tax transcript is a simple and free process. Learn the different types of tax return transcripts and how to order them including irs get transcript online or by mail. You can request a free tax transcript from the irs online through the get transcript tool on its website. Printing a copy of your old tax return on freetaxusa. Irs transcripts are best and most often used to validate past income and tax filing status for mortgage and other loan applications, and to help with tax preparation. You can also get tax transcripts from the irs by making a request via. Check if you're eligible to use direct file, the new free tax tool to file your federal taxes. This form allows you to request a transcript of your tax return or other tax information from the irs. Transcripts are free and faster to obtain, while copies incur a fee and take longer to process. Learn how to get a free transcript or a copy of your federal tax return online, by phone, or by mail. Requesting a tax. Irs transcripts are best and most often used to validate past income and tax filing status for mortgage and other loan applications, and to help with tax preparation. Requesting a transcript by mail is possible as well, but it can. The irs even has an online portal, which you can use to request either a pdf on your computer or. Learn the different types of tax return transcripts and how to order them including irs get transcript online or by mail. An official website of the united states government. Get the tax account transcript for the agi shows basic tax return data such as filing status, taxable income, and payment types. View, print or download it in your business tax. Learn how to get a free transcript or a copy of your federal tax return online, by phone, or by mail. Requesting a tax transcript is a simple and free process. Irs transcripts are best and most often used to validate past income and tax filing status for mortgage and other loan applications, and to help with tax preparation. How. How can i request a tax transcript? An official website of the united states government. Find out the difference between transcripts and copies and when you may. Get the tax account transcript for the agi shows basic tax return data such as filing status, taxable income, and payment types. Learn how to get a free transcript or a copy of. This form allows you to request a transcript of your tax return or other tax information from the irs. Get the tax account transcript for the agi shows basic tax return data such as filing status, taxable income, and payment types. Requesting a tax transcript is a simple and free process. Find out the difference between transcripts and copies and when you may. Requesting a transcript by mail is possible as well, but it can. Irs transcripts are best and most often used to validate past income and tax filing status for mortgage and other loan applications, and to help with tax preparation. You can choose from different types of transcripts, such as return, account, record,. You can also get tax transcripts from the irs by making a request via. Printing a copy of your old tax return on freetaxusa is free. You can easily get a free copy of your tax transcript by creating or logging into your online irs account. Learn the different types of tax return transcripts and how to order them including irs get transcript online or by mail. The irs even has an online portal, which you can use to request either a pdf on your computer or a paper copy in. How can i request a tax transcript? There are 2 ways to get a business tax transcript: Check if you're eligible to use direct file, the new free tax tool to file your federal taxes directly with the irs. For fast help, go online to www.irs.gov and click on get your.Irs Form 4506 A Fillable Printable Forms Free Online

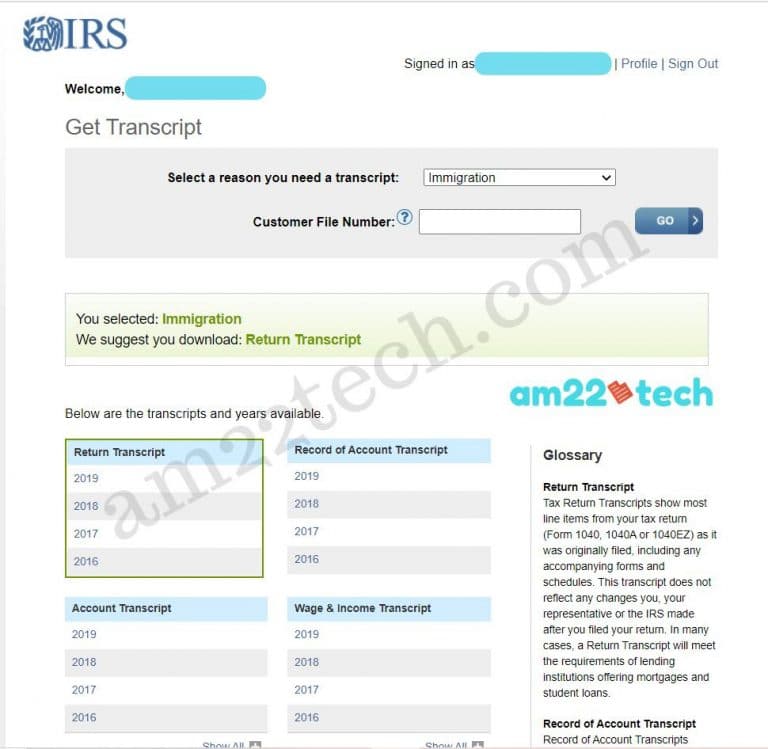

How to get IRS Tax Transcript Online (for i485 Filing) USA

Fillable Online Tax Return Transcript 012345678 1120S YYYYMM COMP Fax

How To Get A Tax Return Transcript In 10 Minutes Shared Economy Tax

How to get IRS Tax Transcript Online (for i485 Filing) USA

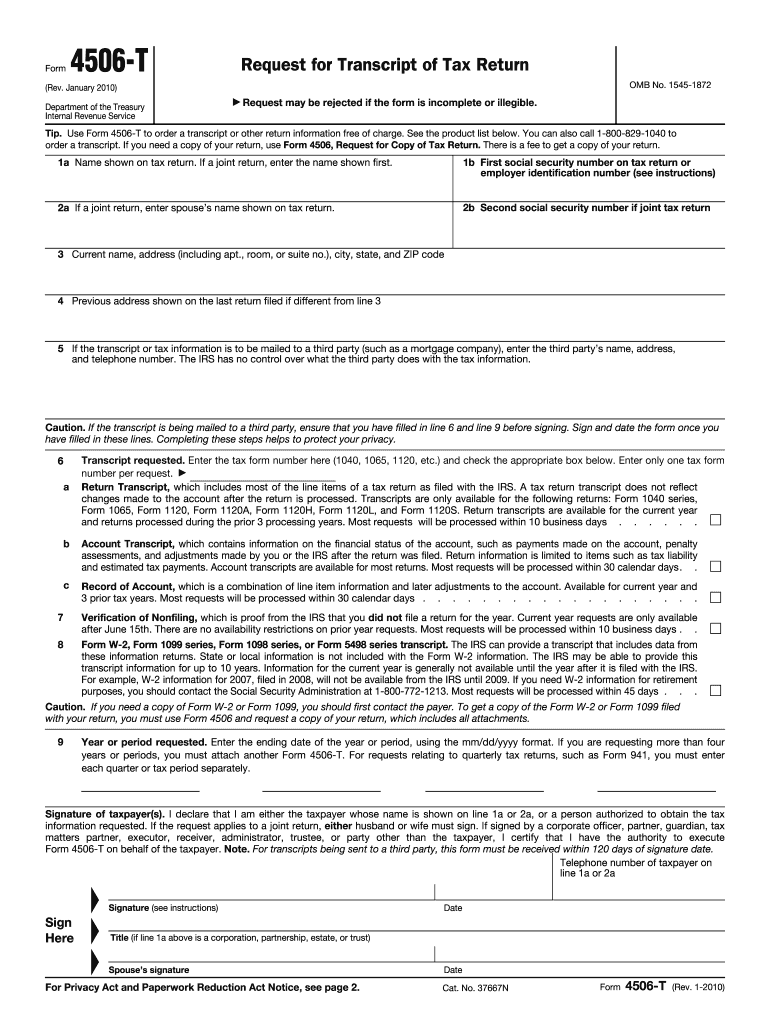

IRS Form 4506T Download Fillable PDF or Fill Online Request for

Fillable Form 4506T Request For Transcript Of Tax Return printable

Tax Return Transcript Example Fill Online, Printable, Fillable, Blank

Tax Transcript Decoder NHASFAA! Doc Template pdfFiller

4506 T Printable Form Printable Forms Free Online

You Can Request A Free Tax Transcript From The Irs Online Through The Get Transcript Tool On Its Website.

It Also Shows Changes Made After Filing The.

Transcripts Are Free And Faster To Obtain, While Copies Incur A Fee And Take Longer To Process.

An Official Website Of The United States Government.

Related Post: