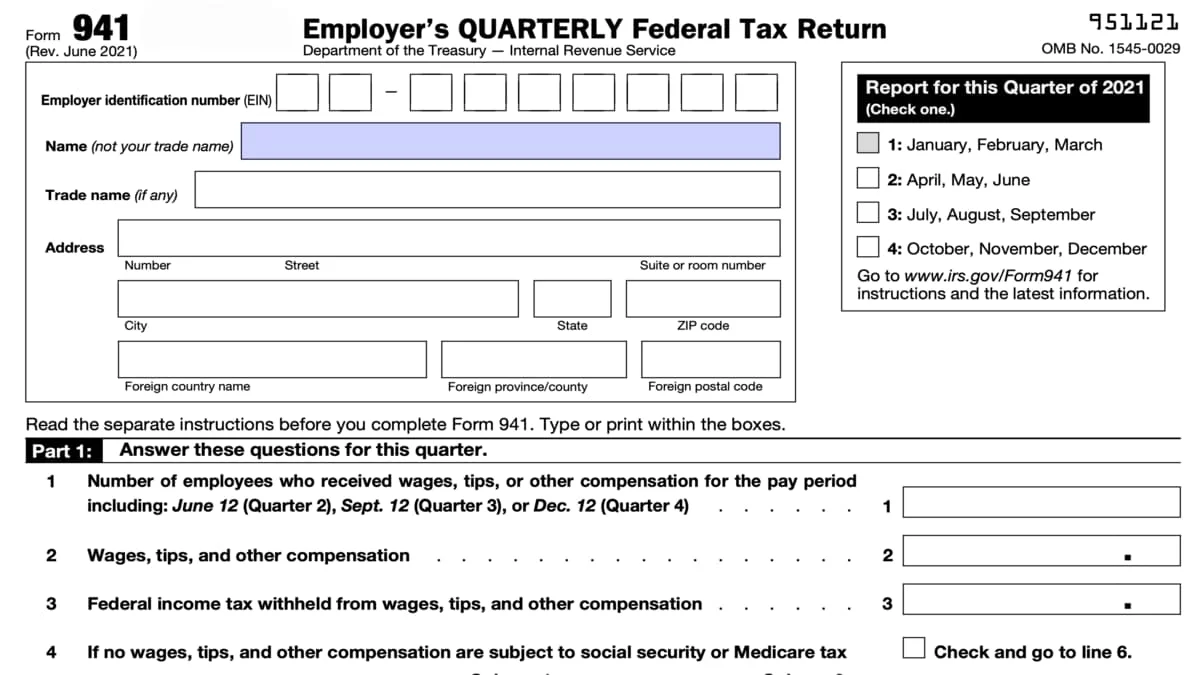

Printable 941 Form

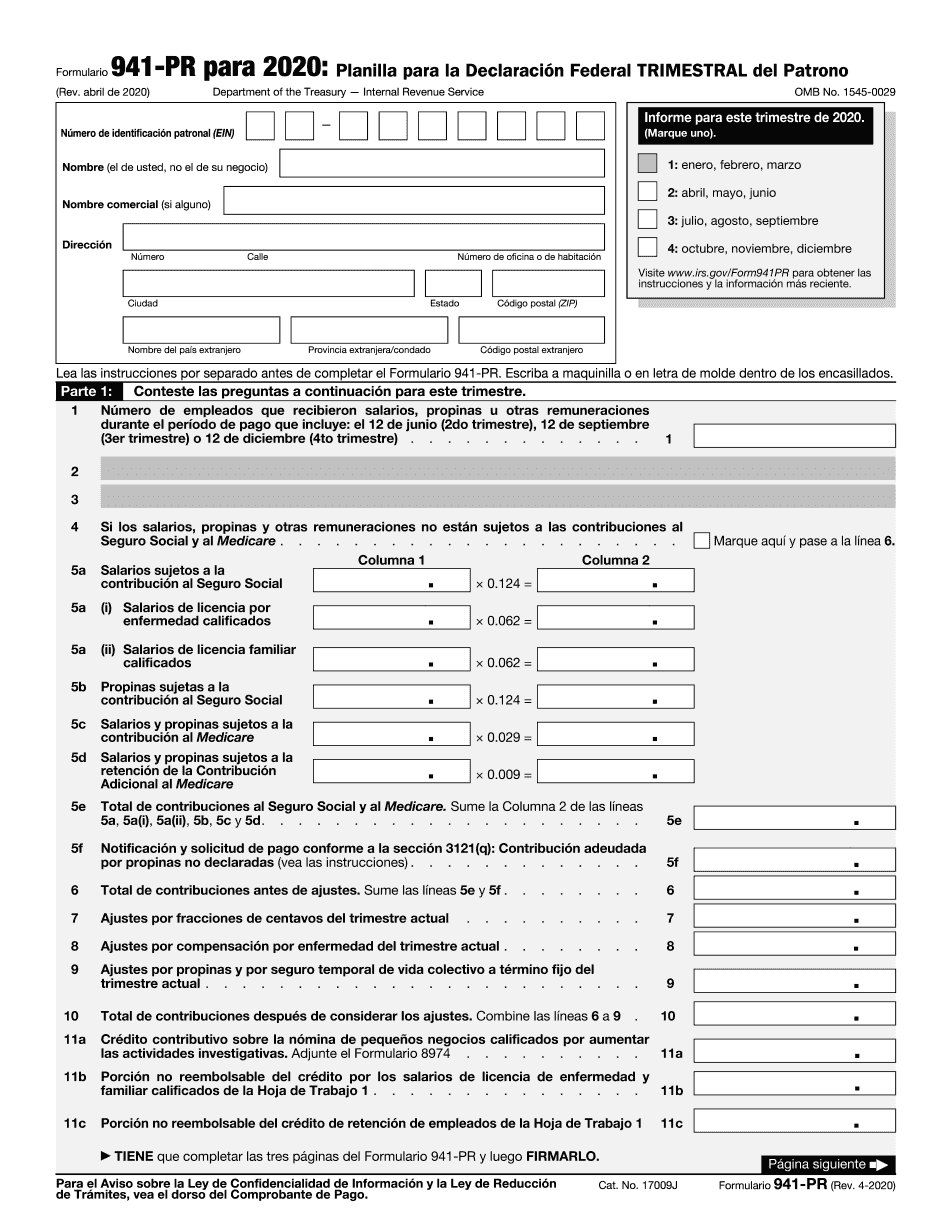

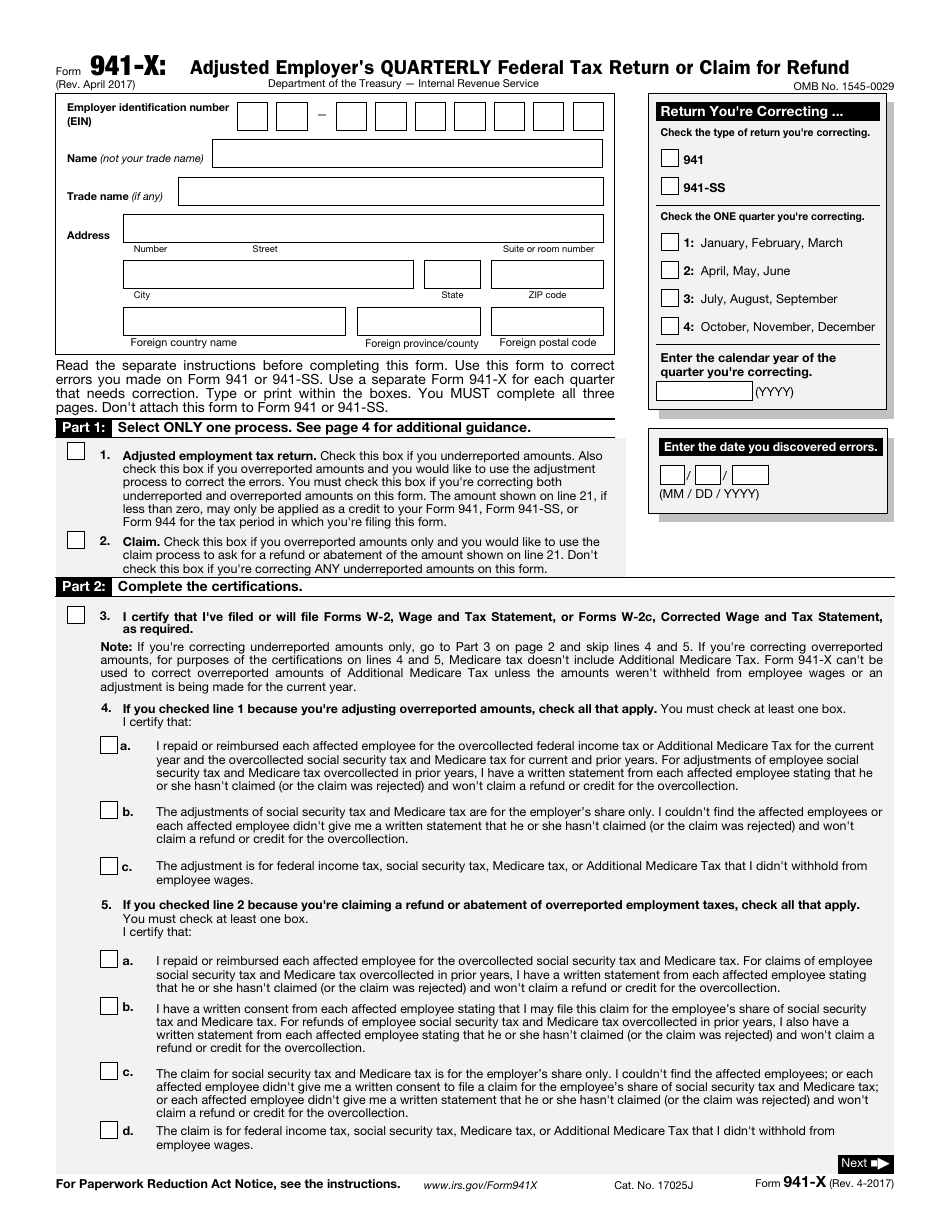

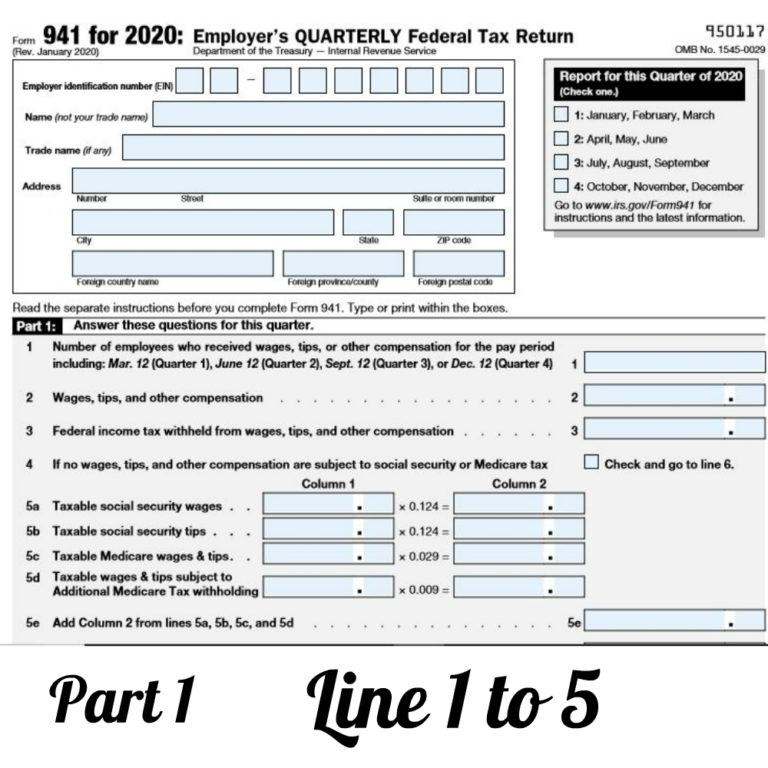

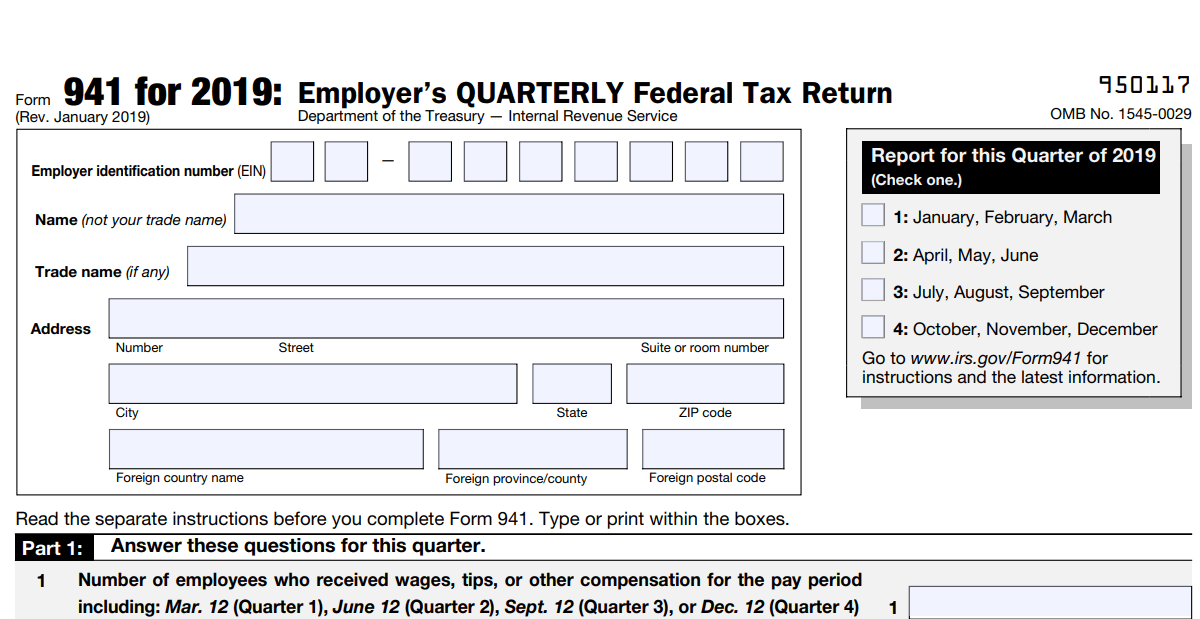

Printable 941 Form - 1 number of employees who received wages,. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. Number of employees who received wages,. Answer these questions for this quarter. Answer these questions for this quarter. Request for taxpayer identification number (tin) and certification. 1 number of employees who received wages,. Read the separate instructions before you complete form 941. Read the separate instructions before you complete form 941. Type or print within the boxes. This form must be filed quarterly with the irs to ensure federal payroll tax regulations compliance. Employers notified by the irs to file form 944, or employer's annual federal tax return, will file annually instead of using the quarterly form 941. Answer these questions for this quarter. Read the separate instructions before you complete form 941. Number of employees who received wages,. The latest versions of irs forms, instructions, and publications. If a pdf file won't open, try downloading the file to your device and opening it using adobe acrobat. Request for taxpayer identification number (tin) and certification. Answer these questions for this quarter. Read the separate instructions before you complete form 941. This form is for income earned in tax year 2024, with tax returns due in april 2025. Answer these questions for this quarter. Read the separate instructions before you complete form 941. Download this free form 941 in pdf and confidently complete it using. Request for taxpayer identification number (tin) and certification. Read the separate instructions before you complete form 941. We will update this page with a new version of the form for 2026 as soon as it is made available by the. Type or print within the boxes. For the best experience, open this pdf portfolio in acrobat x or adobe reader x, or later. Number of employees who received. Answer these questions for this quarter. Employers notified by the irs to file form 944, or employer's annual federal tax return, will file annually instead of using the quarterly form 941. Employers in american samoa, guam, the. Read the separate instructions before you complete form 941. Read the separate instructions before you complete form 941. Employers in american samoa, guam, the. Download this free form 941 in pdf and confidently complete it using. Read the separate instructions before you complete form 941. Download and print the pdf form for reporting wages, tips, and other compensation for the quarter of 2022. Type or print within the boxes. Request for taxpayer identification number (tin) and certification. 1 number of employees who received wages,. Number of employees who received wages,. Follow the instructions and complete the three pages of form 941, including. We will update this page with a new version of the form for 2026 as soon as it is made available by the. Employers in american samoa, guam, the. Download this free form 941 in pdf and confidently complete it using. The latest versions of irs forms, instructions, and publications. Read the separate instructions before you complete form 941. This form is for income earned in tax year 2024, with tax returns due in april 2025. Read the separate instructions before you complete form 941. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. Type or print within the boxes. Read the separate instructions before you complete form 941. Request for taxpayer identification number (tin) and certification. Type or print within the boxes. Type or print within the boxes. Read the separate instructions before you complete form 941. 1 number of employees who received wages,. If a pdf file won't open, try downloading the file to your device and opening it using adobe acrobat. Answer these questions for this quarter. Type or print within the boxes. Type or print within the boxes. Download and print the pdf form for reporting wages, tips, and other compensation for the quarter of 2022. We will update this page with a new version of the form for 2026 as soon as it is made available by the. This form must be filed quarterly with the irs to ensure federal payroll tax regulations compliance. Read the separate instructions before you complete form 941. Read the separate instructions before you complete form 941. Download and print the pdf form for reporting wages, tips, and other compensation for the quarter of 2022. Type or print within the boxes. Answer these questions for this quarter. Answer these questions for this quarter. For the best experience, open this pdf portfolio in acrobat x or adobe reader x, or later. Number of employees who received wages,. We will update this page with a new version of the form for 2026 as soon as it is made available by the. 1 number of employees who received wages,. Read the separate instructions before you complete form 941. Read the separate instructions before you complete form 941. Employers notified by the irs to file form 944, or employer's annual federal tax return, will file annually instead of using the quarterly form 941. Read the separate instructions before you complete form 941. Request for taxpayer identification number (tin) and certification. Type or print within the boxes. Read the separate instructions before you complete form 941. Number of employees who received wages,. Read the separate instructions before you complete form 941. Information about form 941, employer's quarterly federal tax.941 Form 2022 Printable PDF Template

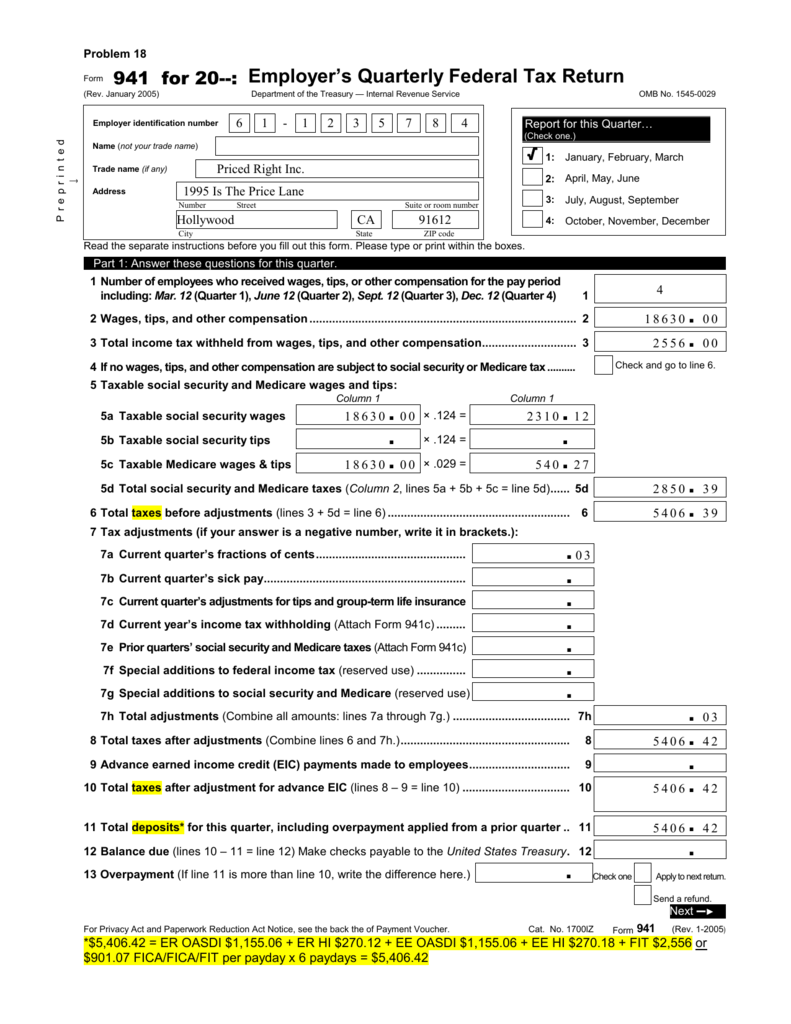

Form 941 for 20 Employer's Quarterly Federal Tax Return

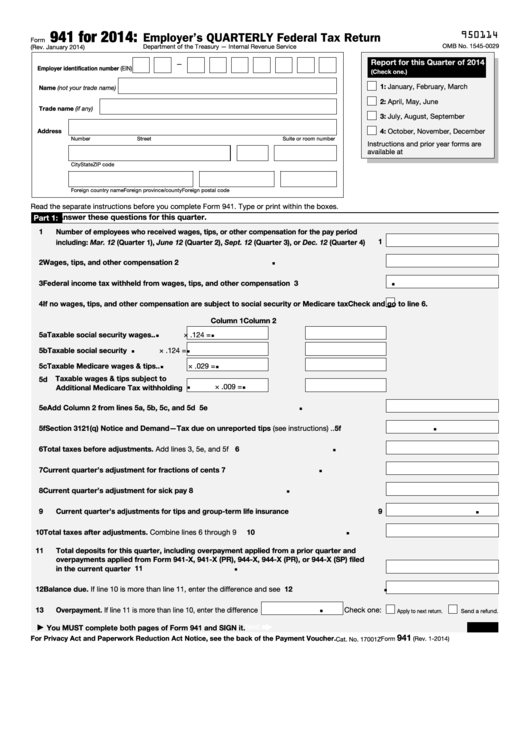

Form Bavar 2018 941 for 2018 Employer's QUARTERLY

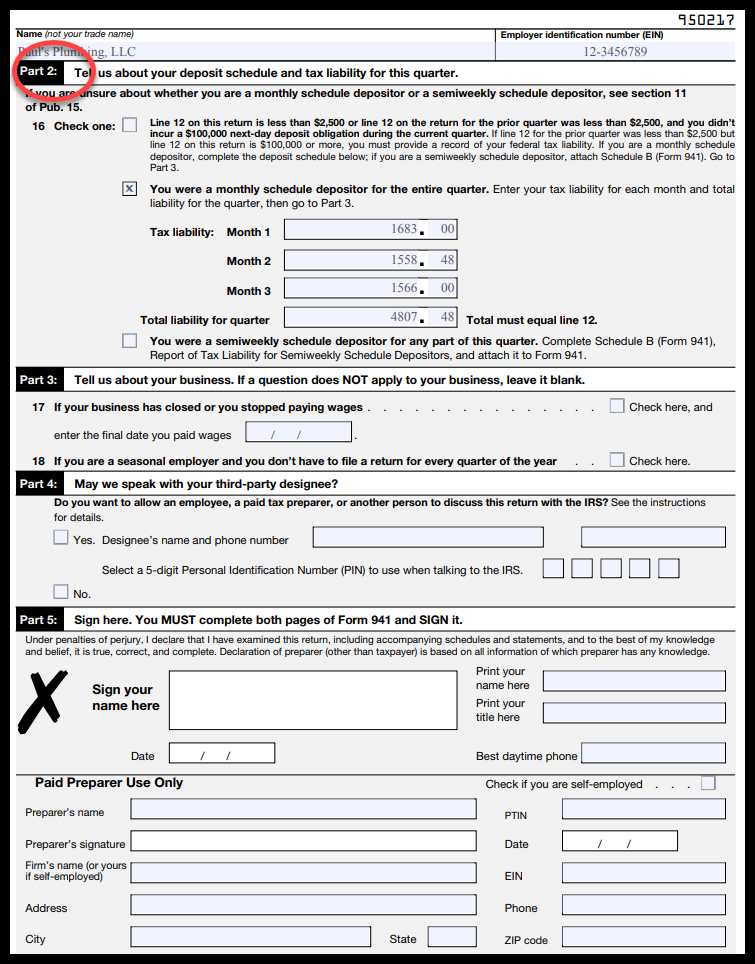

Fillable Form 941 Employer'S Quarterly Federal Tax Return, Form 941V

Printable 941 Form Printable Form 2024

IRS Form 941X Fill Out, Sign Online and Download Fillable PDF

How to Fill Out 2020 Form 941 Employer’s Quarterly Federal Tax Return

What Employers Need to Know about 941 Quarterly Tax Return?

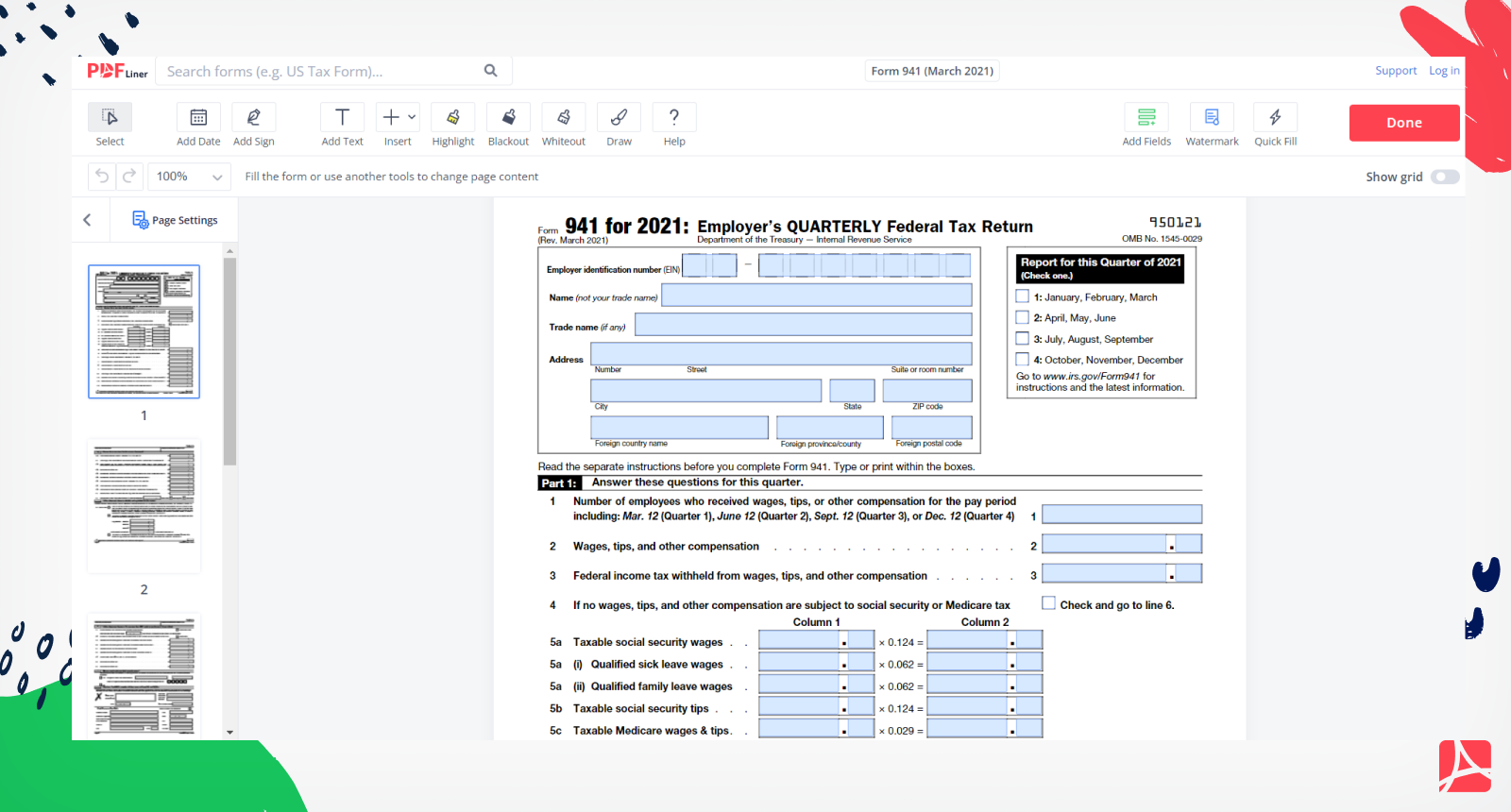

Form 941 (March 2021) Printable Blank Form Online — PDFliner

How to Fill out IRS Form 941 Simple StepbyStep Instructions YouTube

Learn How To Accurately Fill Out Irs Form 941, The Employer's Quarterly Federal Tax Return.

This Form Must Be Filed Quarterly With The Irs To Ensure Federal Payroll Tax Regulations Compliance.

Type Or Print Within The Boxes.

This Form Is For Income Earned In Tax Year 2024, With Tax Returns Due In April 2025.

Related Post: