Printable Daycare Tax Form

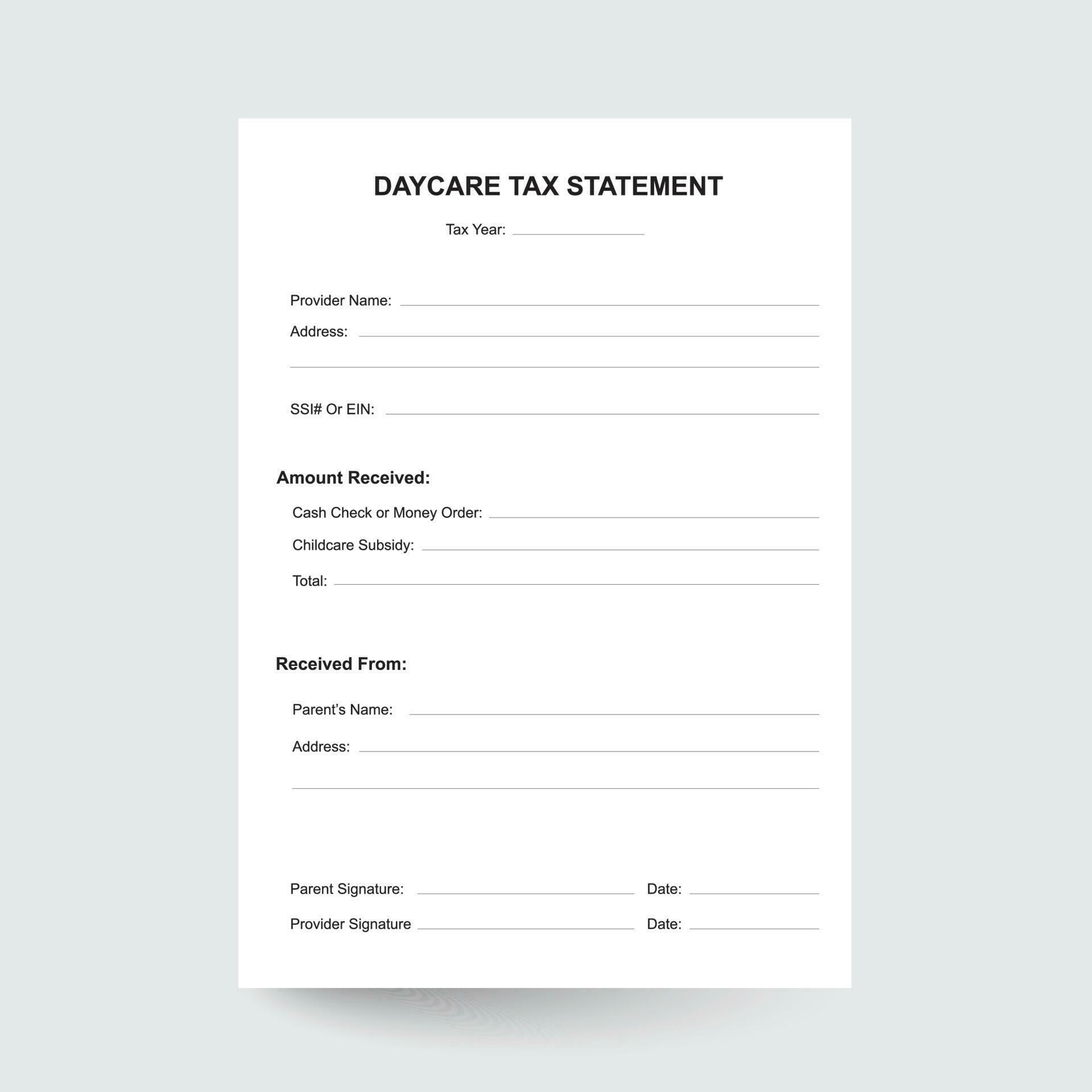

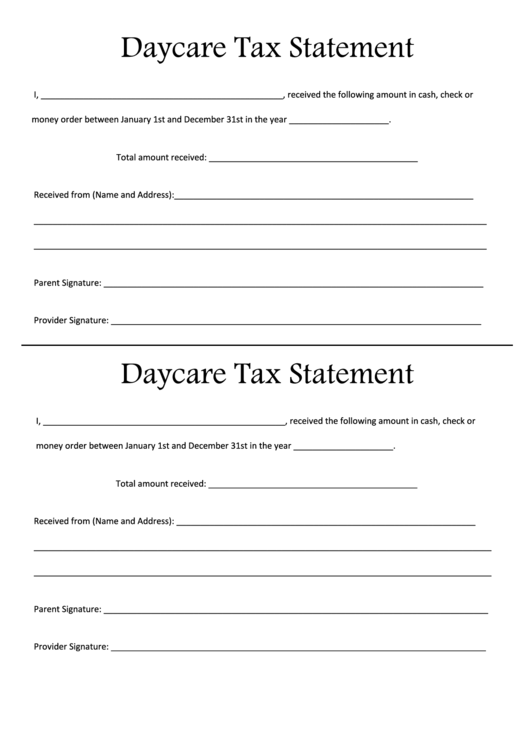

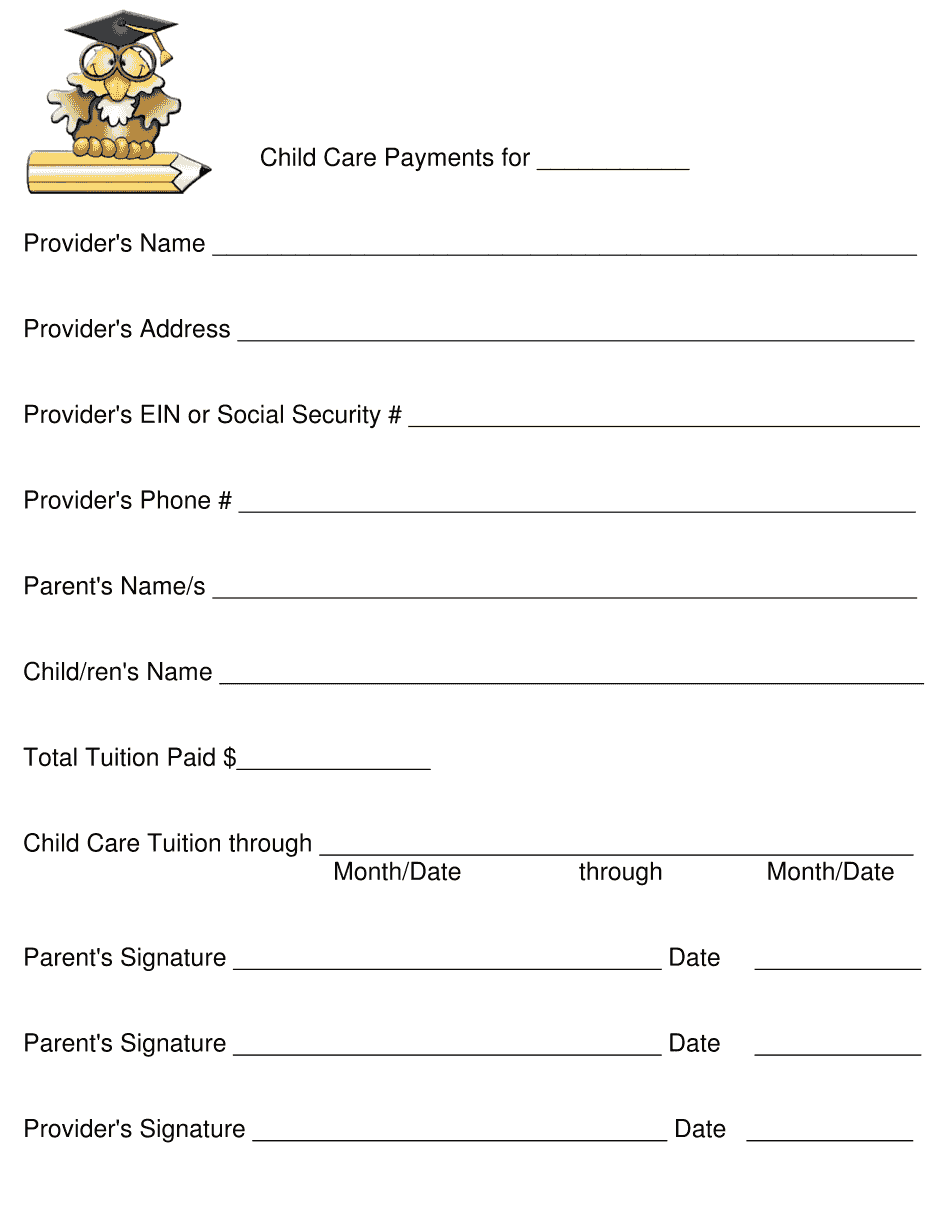

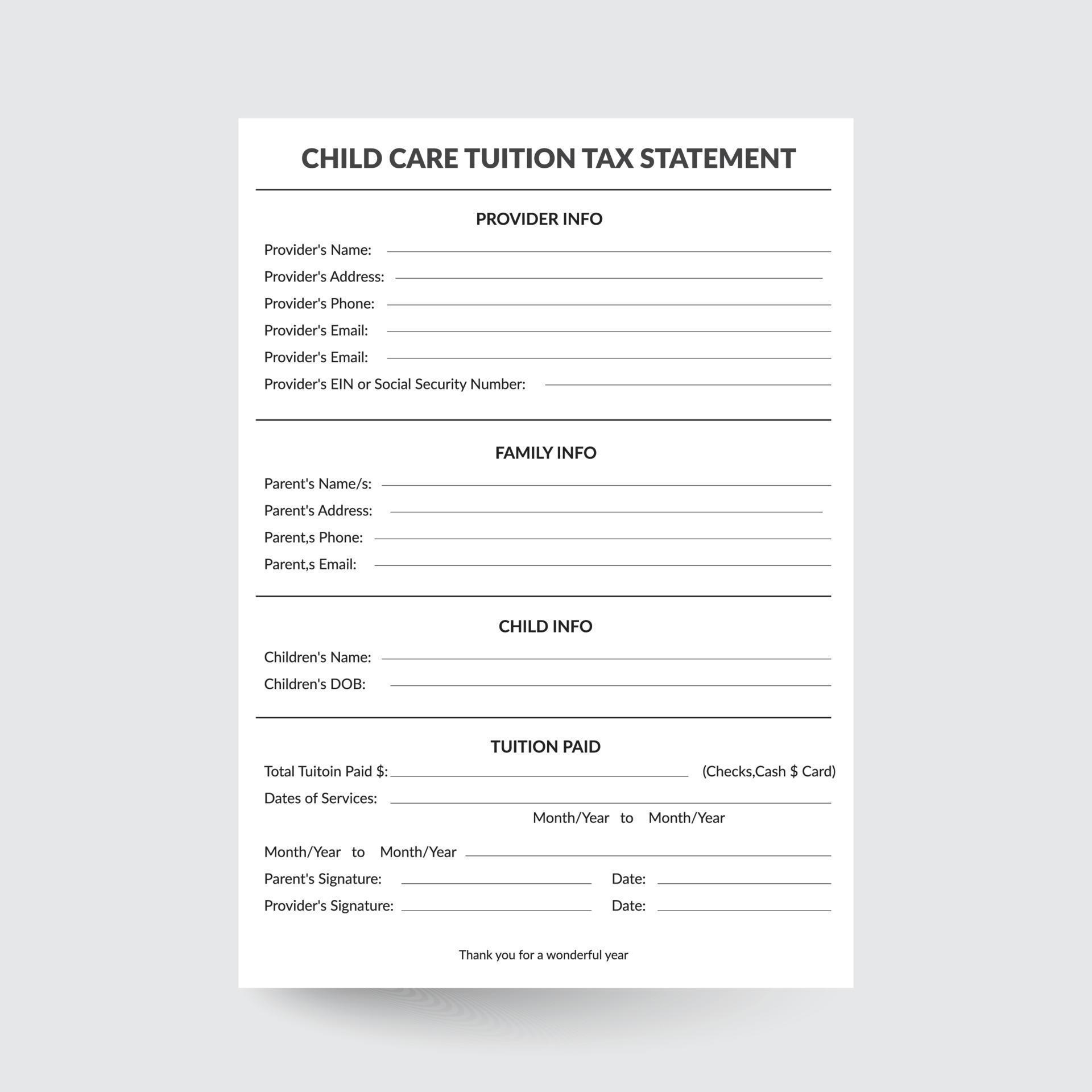

Printable Daycare Tax Form - A childcare receipt form is a document used to provide proof of payment for childcare services. They involve numerous esignature regulations, like esign, ueta and eidas,. Positive discipline for childcare providers by jane nelson, ed.d. If either 1 or 2 above applies, you must show the correct name, address, and taxpayer identification number (tin) of each care provider on form 2441, child and dependent care expenses. The authenticity of a executed paperwork, such as the printable daycare tax forms for parents is defined by particular requirements and rules that you should comply with. According to our records, provided childcare service(s) for <child's name> on the following date(s) in. There are many home daycare forms necessary to operate a home based daycare. Creating them resembles printable forms yet needs some extra actions. I've also included an all about your child form and a sample daily schedule. But most americans have pretty simple taxes: The changes to the child and dependent care tax credit introduced in 2021 under the american rescue plan act temporarily made the tax credit refundable. This is a digital downloadable child care tax statement to be given to parents at the end of the year. Printable child care forms will make starting your business much easier. No need to create forms. After creating the form layout, you must include interactive areas where users can input their info. This form is used for certification of the dependent care provider's name, address, and taxpayer identification number to report on form 2441, child and dependent care expenses. Form 2441 is used to by persons electing to take the child and dependent care expenses to determine the amount of the credit. Positive discipline for childcare providers by jane nelson, ed.d. The authenticity of a executed paperwork, such as the printable daycare tax forms for parents is defined by particular requirements and rules that you should comply with. Information about form 2441, child and dependent care expenses, including recent updates, related forms, and instructions on how to file. If either 1 or 2 above applies, you must show the correct name, address, and taxpayer identification number (tin) of each care provider on form 2441, child and dependent care expenses. A tax return is a form or forms filed with a tax authority that reports income, expenses, and other pertinent tax information. For details, see the instructions for schedule. The template typically includes details such as the provider’s name, address, and tax identification number, as well as the total amount of tax that has been paid to the daycare provider. Attendance forms are the easiest way to keep track of exactly how many hours each of the children are in your care. Printable parent letters and forms. Our records. The template typically includes details such as the provider’s name, address, and tax identification number, as well as the total amount of tax that has been paid to the daycare provider. If you incurred care expenses in 2024 but didn’t pay them until 2025, or if you prepaid in 2024 for care to be provided in 2025, don’t include these. Click on an image or a link for more information about the book. Daycare books to help the provider! A child care professional's guide to reducing stress and avoiding burnout According to our records, provided childcare service(s) for <child's name> on the following date(s) in. They involve numerous esignature regulations, like esign, ueta and eidas,. If the care provider is your household employee, you may owe employment taxes. Creating them resembles printable forms yet needs some extra actions. These child care forms include printable sample forms and child care letters. Neither are required, but both help to promote you as a child care professional. They involve numerous esignature regulations, like esign, ueta and eidas,. A daycare tax statement template is a document that provides information about the amount of taxes that have been paid by a daycare provider. I've also included an all about your child form and a sample daily schedule. The template typically includes details such as the provider’s name, address, and tax identification number, as well as the total amount of. A child care professional's guide to reducing stress and avoiding burnout For details, see the instructions for schedule h (form 1040). The template typically includes details such as the provider’s name, address, and tax identification number, as well as the total amount of tax that has been paid to the daycare provider. Attendance forms are the easiest way to keep. Creating them resembles printable forms yet needs some extra actions. If either 1 or 2 above applies, you must show the correct name, address, and taxpayer identification number (tin) of each care provider on form 2441, child and dependent care expenses. No need to create forms. Click on an image or a link for more information about the book. This. Here are some free printable sample child letters and forms and reports that you can modify and print for your own use. For details, see the instructions for schedule h (form 1040). This is a digital downloadable child care tax statement to be given to parents at the end of the year. A childcare receipt form is a document used. Attendance forms are the easiest way to keep track of exactly how many hours each of the children are in your care. Unlike free printable daycare tax forms printable forms, fillable forms, customers can fill out info directly on the electronic paper. If you incurred care expenses in 2024 but didn’t pay them until 2025, or if you prepaid in. The template typically includes details such as the provider’s name, address, and tax identification number, as well as the total amount of tax that has been paid to the daycare provider. Please do not distribute them for profit. For details, see the instructions for schedule h (form 1040). Here are some free printable sample child letters and forms and reports that you can modify and print for your own use. These child care forms include printable sample forms and child care letters. After creating the form layout, you must include interactive areas where users can input their info. If you incurred care expenses in 2024 but didn’t pay them until 2025, or if you prepaid in 2024 for care to be provided in 2025, don’t include these expenses in column (d) of line 2 for 2024. Daycare books to help the provider! Form 2441 is used to by persons electing to take the child and dependent care expenses to determine the amount of the credit. Tax returns allow taxpayers to calculate their tax liability, schedule tax payments, or request refunds for the overpayment of taxes. Includes a sample contract and policy handbook, emergency, immunization, and transportation forms. It contains essential details such as the date of payment, amount paid, names of the child(ren) receiving care, the service period, and the provider's signature. Simply choose the forms that you feel are best for your daycare. A daycare tax statement template is a document that provides information about the amount of taxes that have been paid by a daycare provider. You receive benefits under your employer’s dependent care plan. A childcare receipt form is a document used to provide proof of payment for childcare services.Printable Daycare Tax Form

Child Care Receipt,Daycare Payment Form,Daycare Tax Form,Printable

Top 7 Daycare Tax Form Templates free to download in PDF format

Daycare Printable Tax Forms Printable Forms Free Online

Daycare Tax Form For Parents Printable

Printable Daycare Tax Statement Form Graphic by LaxmiOwl · Creative Fabrica

DAYCARE TAX STATEMENT/ Childcare Center Printable End of the Year

Daycare Tax Forms Bundle [INSTANT PRINTABLE/DOWNLOAD

Daycare Tax Form for Parents Fill & Edit Printable PDF Forms Online

ChildCare Tax Statement,Child tax statement,Daycare tax form,Daycare

A Child Care Professional's Guide To Reducing Stress And Avoiding Burnout

According To Our Records, Provided Childcare Service(S) For <Child's Name> On The Following Date(S) In.

They Involve Numerous Esignature Regulations, Like Esign, Ueta And Eidas,.

If Either 1 Or 2 Above Applies, You Must Show The Correct Name, Address, And Taxpayer Identification Number (Tin) Of Each Care Provider On Form 2441, Child And Dependent Care Expenses.

Related Post: